Is now right time to drive Digital Modernisation in this period of economic uncertainty?

Many organisations have stopped or paused their digital agenda, but this can only be a short-term option. Organisations need to be ready to exploit the economic recovery in 2021, which means accelerating the digital journey NOW…. The insight provides a view of what are the goals and outcomes required by a business, and the step principles to achieving what we call Digital Energy through delivery of a Digital Powered Business, and the supporting digital ways of working through the Business Technology Operating Model.

Xonetic seek to provide Financial Services organisations with insight on the current considerations for driving Digital Modernisation in this period of economic uncertainty with COVID-19.

THE CHALLENGE

Contradicting forces are driving the need to increase digital momentum

Today’s banking market, across large retail corporates to the small / medium-sized enterprise (SMEs) challengers, is being reshaped by contradictory forces.

Together these forces are challenging traditional business models to serve personal and commercial/ business customers with greater digital enablement – the “new norm” post Covid-19.

Banks need to establish new/enhanced ways to build, innovate and deliver their services and products digitally. Those that do not will be less relevant and risk losing out in this vital marketplace.

This challenge in creating digital momentum or energy, be that of modernisation or overall strategic transformation for some organisation, is that this is set against a backdrop of economic uncertainty.

ECONOMIC OUTLOOK

The impact of COVID19 drives a reset for many organisations in 2020

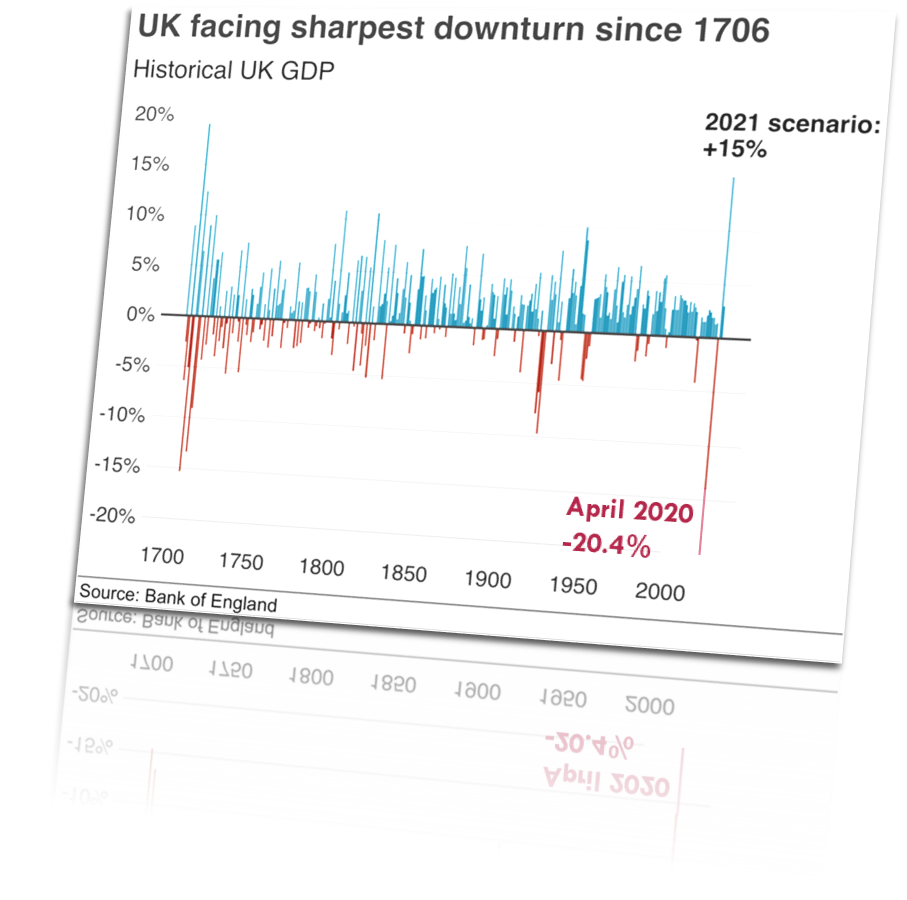

The Bank of England governor Andrew Bailey has suggested that the economy shrunk by 3% in the first quarter of 2020, followed by an unprecedented 20.4% decline in April, rising to 25% in the three months to June.

For the year as a whole, the economy is expected to contract by 14%, which is the biggest annual decline on record, according to Office for National Statistics (ONS).

Whilst the 2020 economic contraction has a major impact on Financial Services organisations, the Bank of England expects UK growth to rebound in 2021 to +15%.

We have a brief respite before the economy comes back online strongly – but operating in a new normal.

DRIVERS FOR EVOLUTIONARY CHANGE...

“Digital Transformation is a fundamental reality for businesses today. Organisations of all sizes realise to delay digital transformation further is to risk obsolescence”

Some 70% of companies had a digital modernisation agenda underway, or were working on one, but it seems many were not far enough along the digital journey to absorb Covid-19 turbulence.

For example we have seen dramatic impacts on Telecommunication, based on the ”new norm” of home working, increased cloud usage which allows companies to scale up (and down) the demand of IT capacity or the virtualisation of customer interaction through multiple digital channels.

With the economic impacts, many companies have stopped or paused their digital energy agenda, but this can only be a short-term option. Organisations need to be ready to exploit the economic recovery in 2021, which means accelerating the digital journey NOW….

…TO ACHIEVE DIGITAL ENERGY GOALS AND OUTCOMES

Let Information Technology (IT) be an enabler to Digital Energy

The goal of digital energy, through modernisation, is to use technology and partnerships to solve traditional problems, which means integrating technology into every area of the business model:

Optimisation for Efficiencies, Improved Capability and Cost Savings;

Cultivation of talent through enhanced Ways of Working; and

Evolve Cybersecurity and Fraud Prevention for an Agile and Resilient Defence Posture.

When applied continuously Digital Energy allows companies to provide unprecedented value to its customers, and thus support the growth potential of the organisation in this competitive marketplace.

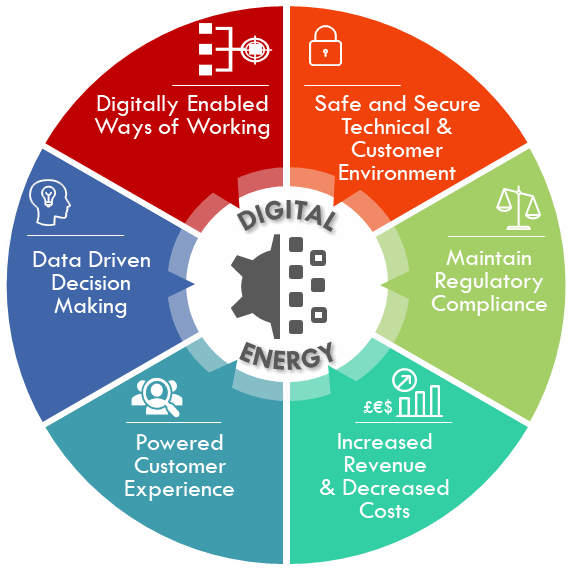

Based on our experience, organisations should consider six (6) Digital Energy outcomes as part of their digital journey.

THE DIGITAL ENERGY OUTCOMES

The six business outcomes that will drive the Digital Energy of your organisation

Powered Customer Experience

The delivery of enhanced Customer digital experience through understanding the service requirements and optimal design of your Customer journey against existing and new business products/services, with access through innovative digital channels and the right digital partners;

Safe and Secure Technical & Customer Environment

Improved security of products and services for your Customers within a constantly evolving digital global threat landscape. This includes Cyber security modernisation, but also Fraud prevention through enhanced online access/ payment security and automated KYC/KYB i.e.: ID Verification, Customer/Business due diligence AML checks for PEPs, Sanctions and Adverse Media;

Data Driven Decision Making

Harness and exploit external and internal organisational data – treat data as a strategic asset. Accelerate delivery, revenue, cost savings and risk decisioning (speed and accuracy) through AI, machine learning or Robotic-enabled capabilities;

Maintain Regulatory Compliance

Build and maintain people, process and technology compliance against the ever-changing regulatory requirements landscape (PRA, FCA, EBA) i.e.: Operational Resilience1, Outsourcing2, Open Banking, Payments, GDPR, etc….; and

Digitally Enabled Ways Of Working

Build a Business operating model (people and process) that complements the Digital modernisation. This needs to include new agile technology enablement Ways of Working for the workforce across all sectors of the banking environment – the “new norm”;

Increased Revenue & Decreased Cost

With enhanced digitally enabled Customer journey (technology, applications, people and processes, with appropriate Right Sourcing/Outsourcing), this will drive increased speed to market and revenue opportunities, against a lower cost to serve for delivery and fulfilment of new and existing products/services.

…AND THE STEPS to DELIVER

10 guiding principles to create Digital Energy for your business

DEFINE YOUR DIGITAL ENERGY

Define your Digital Strategy

Define a 90-day agile value sprint approach

Secure Executive Commitment

Secure the business case investment

INITIATE

DEFINE YOUR DIGITAL ENERGY

Build an experienced delivery team

Perform a proof of value/concept project

Define new Ways of Working operating model

DESIGN

DEFINE YOUR DIGITAL ENERGY

Define and adopt the new Business operating model

Sequence digital energy deliver to drive quick wins

Communication is king!

BUILD

...CONTACT US FOR YOU FREE DIGITAL ENERGY ASSESSMENT

Xonetic provides advisory and delivery capabilities to Financial Services customers today that drive the creation of a Digital Powered Business, and the supporting digital ways of working through the Business Technology Operating Model. This is what we call Digital Energy.

To find out more why not contact us for a FREE Digital Energy Assessment.

To Find Out More Contact Xonetic